Budgeting is a crucial element of financial success. It involves creating a plan for your income and expenses, which can help you manage your money effectively, save for future goals, and pay off debt. However, creating a budget can be a challenging task, especially if you are new to it. Fortunately, the 50/30/20 rule offers a simple and effective method for budgeting your income.

What is the 50/30/20 rule?

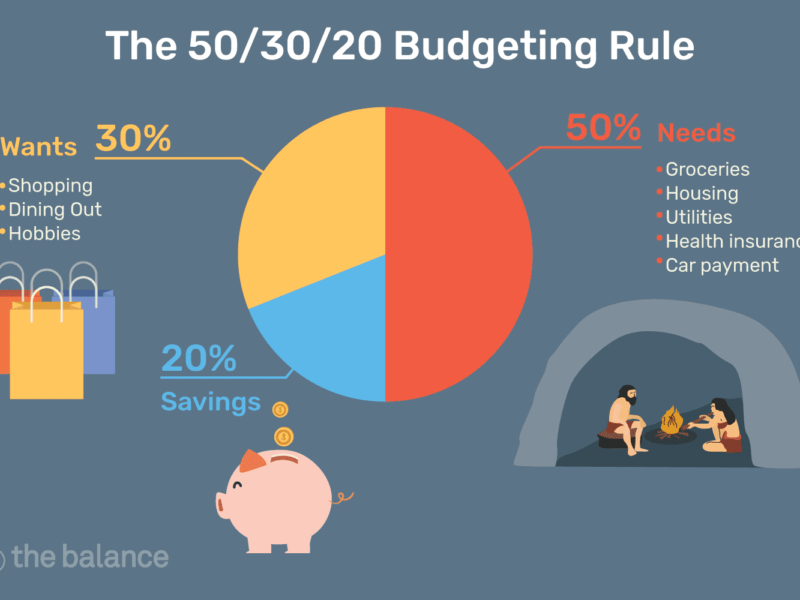

The 50/30/20 rule is a budgeting strategy that suggests allocating your income into three categories: needs, wants, and savings. The rule recommends that 50% of your income should go towards your needs, such as rent, utilities, groceries, transportation, and other bills. 30% of your income should go towards your wants, such as dining out, entertainment, travel, and other non-essential items. The final 20% of your income should go towards savings and debt repayment, such as retirement savings, emergency funds, and paying off debts.

Implementation steps

The first step in implementing the 50/30/20 rule is to determine your after-tax income. Once you have this number, you can allocate your income into the three categories. It is essential to be honest about your spending habits when allocating your income. If you overspend in one category, you will have to adjust your spending in the other categories to ensure you stay within the recommended percentages.

50% for Needs:

The needs category should be given the highest priority in your budget. These are essential expenses that are necessary for your survival and well-being. Examples of needs include housing, utilities, food, transportation, and insurance. These expenses should not exceed 50% of your after-tax income.

It is crucial to note that the 50% allocation for needs is a maximum, and you should aim to reduce your expenses in this category if possible. For example, if you can find cheaper rent, reduce your electricity bill, or carpool to work, you can free up more money for other categories.

30% for Wants:

The wants category includes discretionary expenses that are not essential for your survival but can enhance your quality of life. Examples of wants include dining out, entertainment, travel, and hobbies. This category should not exceed 30% of your after-tax income.

The wants category is often the most challenging category to manage because it is easy to overspend on non-essential items. To avoid overspending, it is essential to create a budget for this category and stick to it. You can also use cash envelopes, limit credit card usage, and prioritize the most important wants.

20% for Savings and Debt Repayment:

The final category in the 50/30/20 rule is savings and debt repayment. This category includes retirement savings, emergency funds, and paying off debts. This category should receive the lowest priority in your budget and should not exceed 20% of your after-tax income.

Savings and debt repayment are crucial for achieving financial stability and achieving your long-term financial goals. The 20% allocation for savings and debt repayment can help you build an emergency fund, pay off high-interest debt, and save for retirement.

Benefits of the 50/30/20 Rule:

The 50/30/20 rule offers several benefits that can help individuals achieve financial success. For starters, it provides a simple and easy-to-follow budgeting method that doesn’t require a lot of time or effort to implement. Additionally, it ensures that individuals cover their essential expenses while still allowing for discretionary spending and savings.

Another advantage of the 50/30/20 rule is that it promotes a balanced financial life. By allocating a reasonable percentage of your income to each category, you can avoid overspending in one area and underspending in another. This balance can help you achieve financial stability and prevent financial stress.

The 50/30/20 rule also encourages individuals to prioritize their financial goals. By allocating 20% of your income towards savings and debt repayment, you can make progress towards achieving long-term financial goals like building an emergency fund, paying off high-interest debt, and saving for retirement.

Finally, the 50/30/20 rule provides individuals with a sense of control over their finances. By creating a budget and sticking to it, individuals can feel empowered to make informed financial decisions and take control of their financial future.

Tips for Successful Implementation:

Implementing the 50/30/20 rule can be challenging, especially if you are used to a different budgeting method or have never created a budget before. Here are some tips to help you successfully implement the 50/30/20 rule:

- Start with a clear understanding of your after-tax income. This will help you determine the amount of money you can allocate to each category.

- Be honest about your spending habits. It’s essential to accurately track your expenses to ensure you stay within the recommended percentages for each category.

- Prioritize your needs. Ensure that your essential expenses are covered first before allocating money to wants or savings.

- Create a budget for your wants. Creating a budget for discretionary spending can help you avoid overspending in this category.

- Automate your savings. Set up automatic transfers to your savings accounts to make saving easier.

- Review and adjust your budget regularly. Regularly reviewing your budget can help you identify areas where you may be overspending or underspending.

Recommended Post:

In conclusion, the 50/30/20 rule is a simple and effective budgeting method that can help individuals achieve financial success. By allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment, you can create a balanced budget that ensures you cover essential expenses, have discretionary spending, and make progress towards your financial goals. With careful implementation and a commitment to following the budget, the 50/30/20 rule can help you take control of your finances and achieve financial stability.